Contents:

If you are Canadian and looking for some of the attractive options available on IBKR Lite, we recommend Qtrade, which has been rated the best broker in Canada in part due to its stellar customer service. If finding a low-fee brokerage is your number one priority, Questrade could be your best option for their low 1 cent fee on stock trades valued at $4.95-$9.95, plus free ETF and Mutual Fund purchases. Finding the best forex broker reviews is not always easy in Canada. At ForexCanada.ca you will find a comparison of all major forex broker reviews sorted by broker type, regulation, trading platform and deposit method.

He has a specific interest in the potential of emerging disruptive technologies and their impact on the future. From stocks to options to currencies to bonds, Interactive Brokers offers a low-cost way to trade just about any type of security under the sun. World-class trading software with a few ‘recommended’ brokers – This is a popular scam where investors are sold or offered free software if they deposit with a ‘recommended’ broker. The scammer earns a commission by referring new clients to a broker, so their goal is to lure in naïve investors with unclaimed promises, simply to earn their commission. That is, traders only need to place a little margin with the broker to control a much larger position in the market. This effectively means that profits on successful trades are amplified.

Chris, I’ve used Questrade personally for a decade now and recommend them to others. I pointed out the inactivity fee and how to avoid it in the article. The TD Waterhouse call line is 24/7 and my on hold time is virtually nil. Because of this I advise my kids to go TDW its worth the slightly higher fees. The MERs for Questwealth SRI portfolios are slightly higher than the regular ETFs (.21%-.35%) but are still very low compared to actively managed mutual funds. These days, more and more Canadians want to hold investments that align with their values.

Stock trading commissions start as low as $4.95, plus $.01 per share (max $9.95), and there are no fees to buy exchange-traded funds , a massive win for fee-conscious ETF investors. Here at RetireHappy, our top pick continues to be Questrade. As Canada’s largest independent online broker, its combination of low fees, a robust trading platform, and excellent customer service is tough to beat. And if you sign up with Questrade using our exclusive link, you’ll also receive $50 in free trades.

Questrade Pros and Cons

Promises of unlimited profits – Scammers will claim things like, “churn out endless profits from the markets round the clock” or “guaranteed profits”. This is simply not true and even the best and most reputable solutions cannot ensure 100% accuracy or even close to that. My 18 years of supporting over 1,300 clients gives me a depth of expertise across all aspects of planning and returning to Canada. No conversion has taken place, no “realized” gain has happened, and therefore there is no tax implication for you in Canada in 2021. Check out some of the considerations, below, before deciding when to convert your foreign currencies back to CAD.

And indeed the next business day the full amount was available on my US banking account. After googling for something like “transfer US dollars to Canada” I found an awesome thread on PersonalFinanceCanada subRedditin which some dude described his approach of receiving payments to his US employer. I was researching how other Canadianswho receive the income from the US deal with the whole thing of exchanging US dollars to Canadian dollars and transferring money to Canada. This makes itone of the most regulated financial companies in the world. Apart from that, OFX also is also obligated to comply with international anti-money laundering laws of these countries. This option is more convenient and cheaper since you do not need to pay any extra fees.

Some banks, like RBC and TD, offer online foreign exchange currency converters for their customers, so you can find out your bank’s exchange rate instantly for the most commonly converted currencies. But before going straight to your bank, it’s a good idea to compare your bank’s rates against an objective source, like the Bank of Canada’s online currency converter. Also check the rates offered by professional currency exchange offices, taking into account any added fees charged by your bank or the currency exchange service.

The Trustpilot Experience

Your daughter’s TFSA shouldn’t receive an inactivity fee if there’s at least $5000 in her account, or she’s under 26. I also really like Wealthsimple, it comes down to how hands-on you want to be with your investing. Wealthsimple will charge you 0.5% but you don’t have to worry about constructing an ETF portfolio or rebalancing it. I too have invested with WealthSimple, very recently, but am wondering if Questrade might be a better option for me. Tom wondering if you could do Wealthsimple ‘s review one of this days.

They introduced the first handheld computers used for trading. Since then, they have remained committed to integrating technology to provide mobile and desktop trading platforms for their clients, among other technology-driven services. Do not worry because the online brokers we offer have eliminated these costs thus making trading even more convenient and profitable for https://forex-reviews.org/ your pockets, you can in fact trade at the cost of the spread only. Trading using CFDs and leverage is incredibly risky due to the nature of trading borrowed money and while a leveraged trade can increase profits, it can also lead to drastic losses. Those intending to invest with leverage should look for the best CFD Forex brokers that allow clients to open CFD accounts.

Certification is the motion where the court determines whether the action can properly be pursued as a class action. The court will consider factors such as whether the claims of the class members raise common legal and/or factual issues and whether a class action is the preferable method of pursuing the claims . January 16, 2019 The portal to make an application for compensation under the settlement fund in this action is now open. A copy of the notice explaining how to apply for compensation is available here.

In this scam, investors are encouraged to join a service or company that trades the Forex market, and they will earn fixed periodic profits. This is a pure scam because the Forex market is fast and dynamic. Profits and losses are part of Forex trading and cannot be forecasted. It is virtually impossible to generate guaranteed profits out of the market. There is no foolproof strategy that doesn’t generate some losing trades, and anyone promising guaranteed profits out of the Forex market is simply out to separate you from your money. In summary, shopping around for the best foreign exchange rate (including fees!) is in your financial interest if you are moving large amounts back to Canada when you return.

- The main platform is certainly the so-called “Forex Trader Pro”.

- Over 200 currency pairs may be traded and under the heading Knowledge Center.

- You can also buy ETFs, mutual funds, options, and several other Canadian investments using the brokerage.

- Other types of registered accounts would not be made available.

XTB Forex even includes insurance for all of their customers, covering up to 1M EUR, AUD and GBP in cover in case of bankruptcy.

Questwealth has a dedicated portfolio for the socially conscious investor, called SRI portfolios. Monitor your investments, get real-time quotes, and set up instant notifications with custom alerts. Questrade’s consolidated charts allow you to get a quick read on how your investments and overall portfolio is performing. The company canadian forex review is regulated by the Investment Industry Regulatory Organization of Canada and is a member of the Canadian Investor Protection Fund . Interactive Brokers also has a strong track record of safety and security, with no customer losses ever reported. Margin rates are based on a blended system with tiers based on dollar amount.

Best For-ex exchange service in Canada

The settlement is a compromise of disputed claims and Goldman Sachs does not admit any wrongdoing or liability. The settlement is a compromise of disputed claims and JPMorgan does not admit any wrongdoing or liability. The settlement is a compromise of disputed claims and HSBC does not admit any wrongdoing or liability. The settlement is a compromise of disputed claims and RBS does not admit any wrongdoing or liability. May 29, 2017 Standard Chartered plc entered into a formal settlement agreement whereby Standard Chartered plc agreed to pay CAD$900,000.

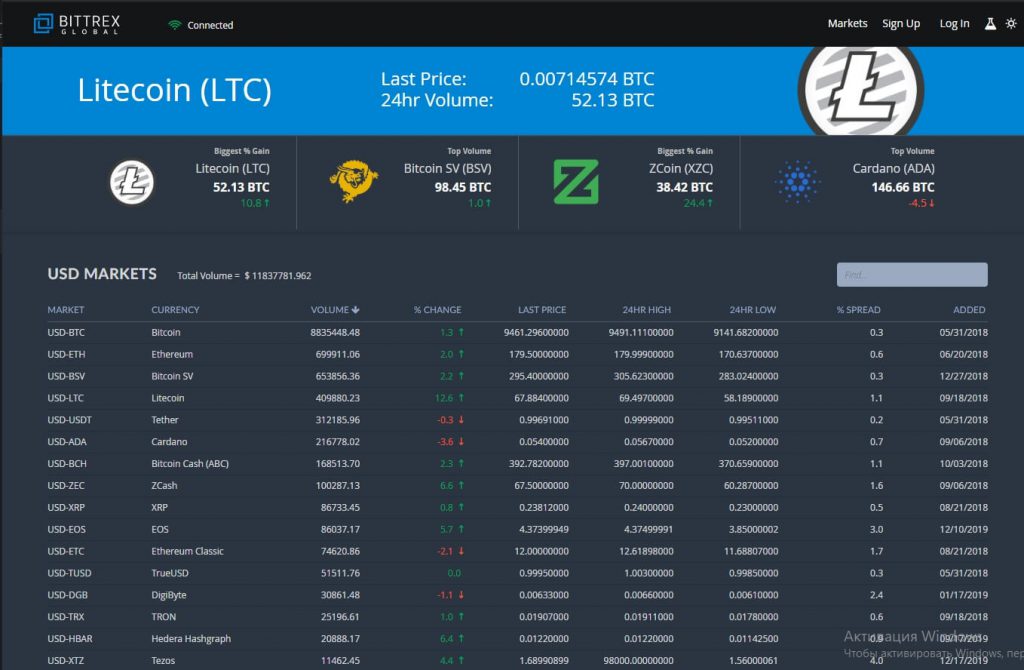

In total, over 200 currency pairs and various CFDs on commodities or indices may be traded. Using the USD/CAD currency pair as an example, the currency on the left is known as the base currency while the currency on the right is the quote currency. The exchange rate between the two is how much of the quoted currency you need in order to buy 1 unit of the base currency. The best Forex brokers in Canada include AvaTrade, Fusion Markets, Questrade and XTB. While not all of them are headquartered in Canada, they serve Canadian Forex traders well by being regulated and reliable, while also being low-spread Forex brokers. Do an internet search for the company name and verify the contact information with the financial institution or firm directly.

Questrade Review: Still the best Canadian online brokerage?

That will allow us to determine what the issuer committed to charging you in the first place, and what you ought to have been charged that day. We’re not currency experts, but the loonie has not been this low since 2009. If you look at historical charts since 1976, the dollar has not been this weak very often. However, some people prefer converting their currency over time i.e. X$’s per week or month, so they don’t rely on one days timing. Timing the market perfectly is hard, but you can at least rely on the fact that now is a historically good time.

My personal experience with OFX Canada

If you have holdings of currencies that are strong now on a historical basis, consider moving more money now. Access to historical rates on foreign exchange company sites is free and easy to find on the internet. When moving back to Canada some years ago, I personally fell into the trap of wanting to have all of my money in Canada when I arrived back. I converted our holdings to CAD and set up life in Canada with those funds before I actually returned.

So let’s determine what are the main characteristics to identify in choosing the best forex broker in Canada to choose when reading the forex trading brokers reviews on the internet. Additionally, the broker’s terms and conditions can be called up at any time free of charge on the website. You’ll also read in the data protection regulations what happens to the info entered and the way they’re used.